The Maryland Department of Legislative Services (DLS) recently released its annual report detailing state aid to local governments for fiscal year 2023. State education funding to local jurisdictions is one of the topics discussed in the report.

Highlights

State aid for education to local governments increases across the board for fiscal year 2023.

The majority of State education aid falls into one of three categories.

General Education Aid

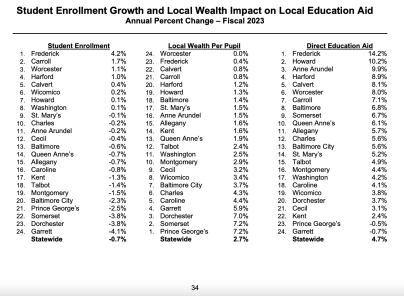

General Education Aid provides a minimum level of operating support for all students, driven by total student enrollment and local wealth. The foundation program is the main program in general education aid and accounts for almost half of State education aid. The foundation program ensures a base level of funding. The foundation program is calculated by multiplying the per-pupil foundation amount by local enrollment.

Foundation Program

At the statewide level, the foundation formula is designed to have the State pay roughly 50% of program costs; however, the State’s share for the less wealthy jurisdictions is higher than 50% and the State’s share for more wealthy jurisdictions is lower than 50% (wealth equalization).

- The amount of State aid that a jurisdiction receives is based on FTE student enrollment and local wealth

- No jurisdiction may receive less than 15% of the base per-pupil amount from the State

Other General Education Aid

Geographic Cost of Education Index (GCEI): GCEI is a Maryland‐based index that adjusts the amount of State aid a local school system receives based on regional differences in the cost of educational resources.

- The GCEI formula does not reduce funding for jurisdictions where educational resources are less expensive

- Unlike every other major State aid program, GCEI was not mandated until fiscal 2017

- GCEI only applies to the foundation program and the State pays the State and local shares

Guaranteed Tax Base: GTB provides additional funds to jurisdictions with less than 80% of the statewide wealth per pupil that provide local education funding above the minimum local share required by the foundation program.

- The State provides the funds that would have been generated locally if the jurisdiction had the wealth base that is guaranteed

- Per pupil GTB amount for any one local school system is limited to 20% of the per-pupil foundation amount provides a minimum level of operating support for all students, driven by total student enrollment and local wealth.

State Aid Under the Blueprint

Under the Blueprint for Maryland’s Future, the landmark education reform policy, state and local spending are ramped up for targeted initiatives under the law.

Targeted Education Aid

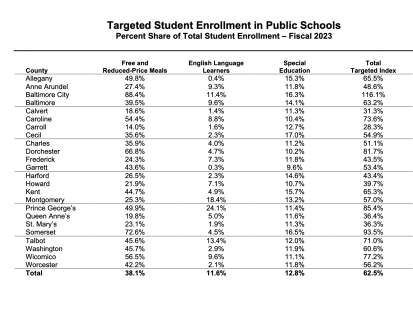

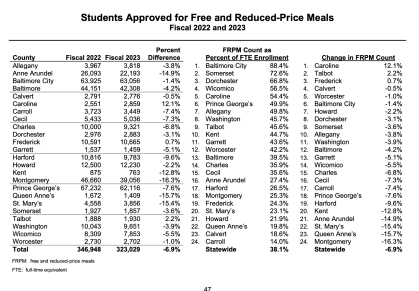

The targeted formulas recognize the additional costs associated with educating certain student populations:

- Special education (0.74 X base level of funding per pupil)

- Compensatory education (based on free and reduced-price meal status) (0.97 X base level of funding per pupil)

• Prekindergarten funding is accounted for in the compensatory education formula - Limited English proficiency (0.99 X base level of funding per pupil)

Although the State provides approximately 50% of the total estimated cost of each program, local governments are not required to provide the other half. Funding amounts and distributions are based on local wealth and enrollments of the three targeted student populations, however, no jurisdiction may receive less than 40% of the full per-pupil amount from the State.

Noninstructional State Aid

Student Transportation: Each local school system is required to provide transportation to and from school for all public school students.

- Transportation funding consists of a base grant that is adjusted annually and a per pupil grant based on the number of students with special transportation needs

Other Noninstructional Aid: Includes early education, food service, adult education, and a variety of innovative programs.

Teacher Retirement Costs

- Prior to 2012, the State paid 100% of teacher retirement costs

- In 2012, legislation required locals to share in the cost of retirement

- Retirement aid is not wealth equalized

- In fiscal 2016, local share ranged from 25%-30%

Maintenance of Effort and the 2022 Legislative Adjustment

State aid to local education is backdropped by the context of the state’s “Maintenance of Effort” (MOE) law that requires locals to fund public education at a dollar amount at least equal to that of the previous year’s.

In the final weeks of the 2022 General Assembly session, legislators clarified and altered the “Maintenance of Effort” law for 2022 to remedy a series of miscalculations were revealed. The General Assembly ultimately passed a bill to address these conditions, some unique to the ongoing COVID-19 pandemic:

- Counties whose share of Kirwan programs is greater than their calculation of “Maintenance of Effort” local contributions will be unaffected;

- Counties with enrollment declines (Sept 2021 count, versus Sept 2019 count) who would have otherwise been able to reduce overall funding would be required to at least fun the same total dollars as in FY22 (the Department of Legislative Service’s report details enrollment changes over this period); and

- Counties affected by this mandate would have that required extra funding backed out of their per-pupil funding base when next year’s funding requirement is calculated, which avoids the one-year patch for enrollment drops to become a permanently mandated amount.

Fiscal Year 2024 Projections

The Department of Legislative Services also published analysis projecting state aid to local education for fiscal year 2024. Those predictions are subject to change via legislative allocations during the 2023 legislative session and budget process.

Access the full DLS report on fiscal year 2023 state aid to local governments.