The Maryland Department of Legislative Services recently released its annual report detailing state aid to local governments. State education funding is one of the topics discussed in the report.

Highlights

The Governor’s 2019 budget proposal increases state public education funding by 2.5%. The bump is a combination of mandated formulaic increases and $15.2M in hold-harmless grants to ensure no jurisdiction receives less state education aid than it did in 2018.

The majority of State education aid falls into one of three categories.

General Education Aid

General Education Aid provides a minimum level of operating support for all students, driven by total student enrollment and local wealth. The foundation program is the main program in general education aid and accounts for almost half of State education aid. The foundation program ensures a base level of funding. The foundation program is calculated by multiplying the per-pupil foundation amount by local enrollment.

Foundation Program

At the statewide level, the foundation formula is designed to have the State pay roughly 50% of program costs; however, the State’s share for the less wealthy jurisdictions is higher than 50% and the State’s share for more wealthy jurisdictions is lower than 50% (wealth equalization).

- The amount of State aid that a jurisdiction receives is based on FTE student enrollment and local wealth

- No jurisdiction may receive less than 15% of the base per-pupil amount from the State

Other General Education Aid

Geographic Cost of Education Index (GCEI): GCEI is a Maryland‐based index that adjusts the amount of State aid a local school system receives based on regional differences in the cost of educational resources.

- The GCEI formula does not reduce funding for jurisdictions where educational resources are less expensive

- Unlike every other major State aid program, GCEI was not mandated until fiscal 2017

- GCEI only applies to the foundation program and the State pays the State and local shares

Guaranteed Tax Base: GTB provides additional funds to jurisdictions with less than 80% of the statewide wealth per pupil that provide local education funding above the minimum local share required by the foundation program.

- The State provides the funds that would have been generated locally if the jurisdiction had the wealth base that is guaranteed

- Per pupil GTB amount for any one local school system is limited to 20% of the per-pupil foundation amount provides a minimum level of operating support for all students, driven by total student enrollment and local wealth.

Targeted Education Aid

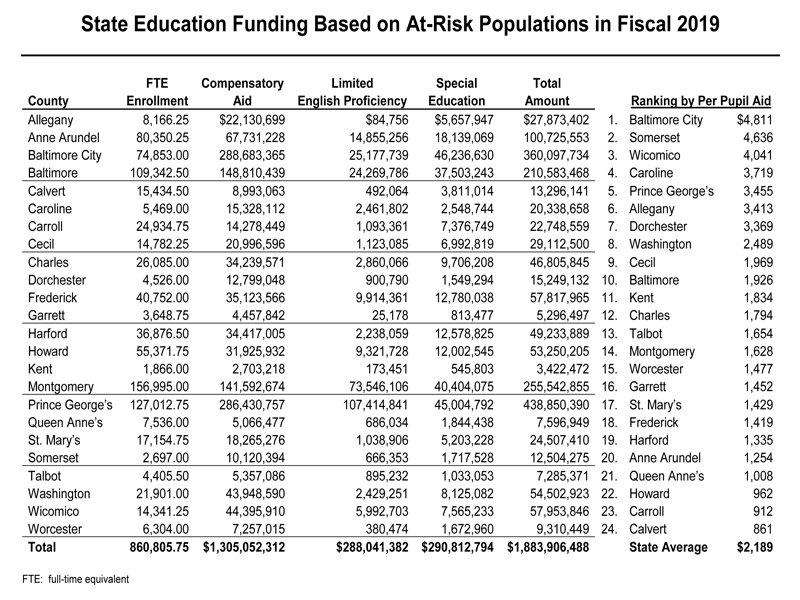

The targeted formulas recognize the additional costs associated with educating certain student populations:

- Special education (0.74 X base level of funding per pupil)

- Compensatory education (based on free and reduced-price meal status) (0.97 X base level of funding per pupil)

• Prekindergarten funding is accounted for in the compensatory education formula - Limited English proficiency (0.99 X base level of funding per pupil)

Although the State provides approximately 50% of the total estimated cost of each program, local governments are not required to provide the other half. Funding amounts and distributions are based on local wealth and enrollments of the three targeted student populations, however, no jurisdiction may receive less than 40% of the full per-pupil amount from the State.

Noninstructional State Aid

Student Transportation: Each local school system is required to provide transportation to and from school for all public school students.

- Transportation funding consists of a base grant that is adjusted annually and a per pupil grant based on the number of students with special transportation needs

Other Noninstructional Aid: Includes early education, food service, adult education, and a variety of innovative programs.

Teacher Retirement Costs

- Prior to 2012, the State paid 100% of teacher retirement costs

- In 2012, legislation required locals to share in the cost of retirement

- Retirement aid is not wealth equalized

- In fiscal 2016, local share ranged from 25%-30%

The Maryland Commission on Innovation and Excellence in Education, Known as the Kirwan Commission because it is chaired by former University System Chancellor Brit Kirwan, is charged with reviewing and assessing current education financing formulas and accountability measures. The Commission was originally set to complete its work in time for the 2018 session of the General Assembly, but last October asked for an extension when it became clear the deadline was not realistic.

After a series of marathon meetings, which featured expert testimony, consultant reporting, and citizen input, the Commission has reached consensus around key policy areas and preliminary recommendations. The Commission expects to complete its work later this year.

You can learn more about education funding by listening to the Conduit Street Podcast.

Useful Links

DLS Report: Overview of State Aid to Local Governments

Previous Conduit Street Coverage: Kirwan Commission Finalizes Preliminary Recommendations

Previous Conduit Street Coverage: Take a “Deep Dive” Into Local Government Financial Info